How to Make a Budget with a Monthly Budget Template

Many individuals, regardless of their income, have likely experienced financial concerns at some point. Whether you’re facing unexpected expenses or trying to understand where your money is going, various factors can lead to worries about your financial habits.

Do you aspire to make wiser financial choices and put an end to overspending? Have you ever considered implementing a monthly budget?

If not, now is the ideal time to create one! Utilizing a monthly budget template can be a valuable tool to help you monitor your finances. By doing so, you can minimize the stress associated with bill payments, unless unforeseen circumstances arise.

In this article, we will explore the utilization of a monthly budget template and elucidate its significance for individuals of all financial backgrounds.

Creating a Monthly Budget

Creating a budget holds tremendous importance in the context of tracking your income and expenses, as it enables you to gain a precise insight into the flow of your finances. A monthly budget serves as your compass, aiding in understanding the remaining discretionary income by month’s end to ensure you don’t fall short when it comes to covering your monthly bills.

If you’ve never ventured into the realm of budgeting before, it might appear daunting initially. However, the process is far more manageable than it appears. While budgeting can consume some time, it becomes fairly straightforward once you’ve gathered all the necessary information.

How Do You Create a Monthly Budget?

Making a personal monthly budget can be tedious, but if you follow these steps, you’ll be able to set one up in no time! There are a few different ways you can create a budget, so we’ll cover those first.

Budgeting Apps

There are numerous applications available for download to assist you with budgeting. While some of these may be free, it’s essential to remember that with free apps, you may not always have access to all the tools and features you require.

Many mobile budgeting applications function as expense trackers and allow you to categorize your expenses into various predefined categories.

If the idea of monitoring your income and expenses from your smartphone appeals to you, explore your app store to find one that suits your preferences.

Ensure that you choose an application that you can easily manage, as it can be challenging to control an app that appears to have a mind of its own.

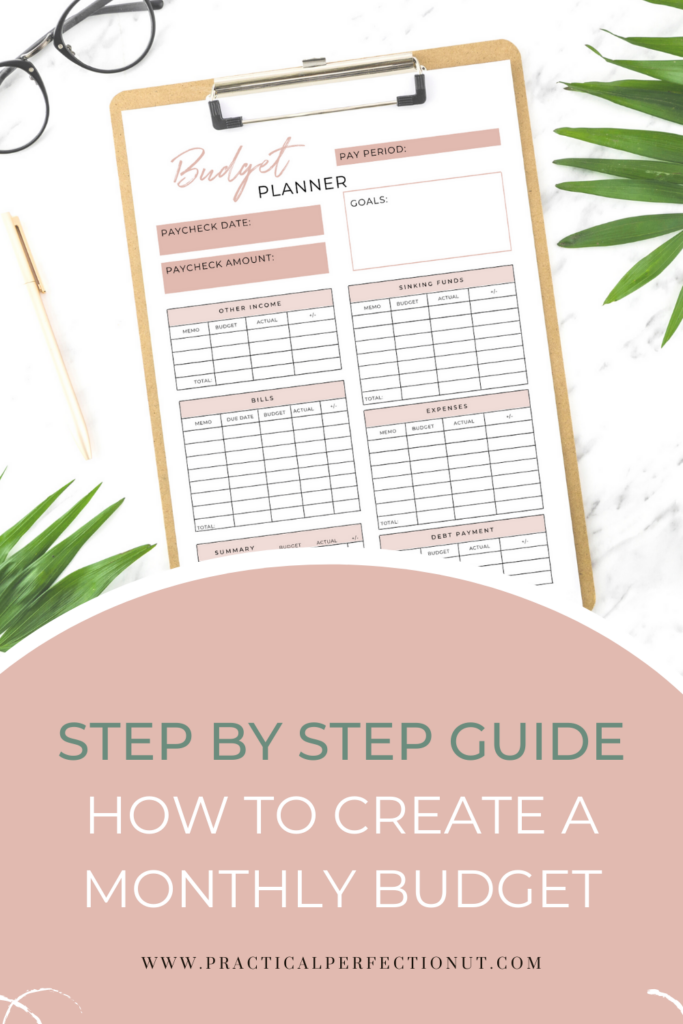

Budget Planner

If you enjoy using physical planners and prefer the act of handwriting, a budget planner could be your ideal choice. Many budget planners serve as templates designed to assist you in monitoring your expenses and financial accounts. You can explore online resources or visit local stores that offer a variety of planners and notebooks to find a budget planner that aligns with your preferences and features a budget template that resonates with your needs.

Budgeting Planner Printables:

Creating Your Own Spreadsheets

If you genuinely desire to tailor your budget to align with your lifestyle and financial situation, consider crafting your personalized budget spreadsheet from the ground up. You can experiment with crafting a monthly budget using either an Excel spreadsheet or Google Sheets.

By employing Excel spreadsheets or Google Sheets on your computer, you have the flexibility to gather and structure your data in a manner that resonates with your preferences. Create an Excel table that intuitively organizes your financial information to suit your needs.

(Excel might be a good choice if you want to make sure you can access your budget spreadsheet even if you’re internet isn’t working well.)

Using Budgeting Templates

Utilizing budget templates proves to be an effortless approach to budgeting, as they come pre-structured, requiring only the input of your financial details.

A budget worksheet or template typically comprises a single page, ideal for consistent monthly use to monitor your income and expenses. Ensure that it accommodates all the necessary data when working on a monthly basis.

Online, there is a wealth of free monthly budget templates available. With the appropriate template, creating a monthly budget becomes a simple task of inputting figures and allocating them to various spending categories.

Download a free budget worksheet or budgeting template online if you’re having trouble creating your own budgeting spreadsheet.

Shop Budget Templates:

Step-By-Step Guide for Making a Budget

Now that you know where you want to create your budget (whether on an app, in a notebook, or on your computer), let’s go through the steps you need to take to actually make it.

1. Gather Necessary Documents

The first step in creating a budget is to gather all of the documents you might need.

This includes:

- a past paycheck or paystubs

- W-2s (or any other forms you use for taxes)

- records of any additional sources of income (like from investing or additional jobs, tips, and services)

- mortgage or rent statements

- utility bills

- credit card bills

- car payment records (if you currently have a car payment)

- statements or receipts from any other bills or expenses

Once you’ve got all of the necessary documents gathered, it’s time to get started on setting up your personal monthly budget!

2. Figure Out Your Total Monthly Income

The next step involves calculating your monthly income. In the context of monthly budgeting, this refers to the total amount of money you earn within a single month, encompassing all income sources such as your salary and any returns from investments.

If you’re not readily aware of your precise monthly income, it’s important to reference the financial documents you’ve gathered earlier – this is precisely why you collected them in the first place.

To create a truly customized budget tailored to your unique circumstances and family needs, it’s crucial to account for every last detail, down to the last cent if possible.

If your income varies from month to month due to the nature of your profession (commonly seen among freelancers, business owners, or self-employed individuals), it’s advisable to record the amount you typically earn during your lowest-earning month. Document your baseline income, which you can consistently rely on. This approach ensures you have a budget that remains applicable every month, even when your earnings fluctuate.

3. Calculate Your Monthly Expenses

Once you know how much monthly income you have to work with, then it’s time to calculate your monthly expenses!

You can do this by taking out what you spend each month and breaking them down into budget categories.

Some of the budget categories you might need are:

- monthly rent or mortgage payment

- monthly utilities, such as electricity and water bills

- car loan payments (if applicable)

- phone bill

- internet bill

- monthly food costs

- insurance (if it’s not already deducted from your salary)

- loans of any kind

- add in any other necessary expenses like childcare or transportation costs

Anything in that category is a necessary expense. Those are things that must be paid first.

You’ll also want another budget category with things you might not need, but you enjoy, such as:

- travel

- entertainment

- eating out

- etc.

Once you know how much money you can allocate to each category in your budget, add them up.

4. Make Adjustments to Spending

Now that you’ve totaled up all of your finances and expenses, look at the total of what you’re spending (aka money going out) versus the total of your earnings (aka the money you have coming in).

If the expense total comes out higher than what you have left after calculating, then you need to try to cut costs in some areas.

Start with entertainment and eating out, or the places where you don’t have to spend as much. While it might not be fun, deciding to eat at home more or not go to the movies as often can really help you not overspend.

If you need to, look at the items in your necessary category, and see where you can cut there.

Obviously, you can’t really cut down on rent or loans, but are you paying for high-speed internet and you could drop down to a cheaper plan? Could you switch phone providers to save on some costs?

Take a look at your budget and see where you can find any savings.

On the other hand, if your total at the end comes out lower than what you’re earning, you have a few options!

You can put the extra amount in savings, look into investing, or pay off any debt you have more quickly.

Shop Savings Trackers:

Stick to Your Budget

Once you have your budget created, stick to it!

Taking the time to track your money and find out how much you are saving (or not saving) will not only help you now but down the line as well.

Whether you are using a free budget worksheet, a planner, or an Excel budget spreadsheet, you now have the tools to manage your expenses.

Abiding by your budget will help lower any stress you have regarding overspending and finances!