Everything you Wanted to know to Teach Kids about Money

There are many ways to help kids learn about money. Whether they are young children, tweens, or teenagers, there are many skills that can be nurtured and taught through working and saving for the things they want. In this article, we will outline how to teach them about money based on their age, how to decide the amount your child should get paid for their work, and in some cases what your child should charge other people for the services they provide. And at the end, we’ll also list money-making strategies for kids of all ages!

Need more ideas? Checkout Kids Chore Chart Free Printable or 104 Ways to Make Money as a Kid or 11 Excellent Reasons to Get the Greenlight Debit Card for Kids or 104 Ways to Make Money as a Kid

When should I start teaching my kids good money habits?

There are many skills that can be nurtured and taught through working to earn money. Whether your kiddos are young children, preteens or teenagers there is an age-appropriate way to teach them these lessons and responsibilities.

It may start with teaching your child the difference between saving vs spending when you buy a treat, for example. You could mention how it’s good if we save some of our money so we have more than enough saved up for what we want later on in life too!

Is it too soon to teach your young kids about money concepts? No! There are money skills that can be taught to children of all ages. This teaching opportunity might happen as early as elementary school! Or, if you’ve got a teenager and are thinking it may be too late to teach them about money, think again! It’s never too early and it’s never too late to teach our kids.

How do I teach my child good money habits?

Kids can be taught good habits as early in life as possible. They need lots of guidance from parents and teachers who have learned these skills themselves. Teachers and other adult mentors can support what parents are teaching their kids; this way parents are not the ones teaching everything! But even if you don’t know all there is to teach your kids about money, the first step you should take is to lead by example: spend wisely; save responsibly; live within your means; and plan for long-term goals (retire), short-term goals (vacation) & emergency savings.

Your example is the best way for your kids to learn. If you decide against purchasing something in the store, verbally tell your kids that you decided not to get it so you could save the money instead. Kids will see the value in this and may even try to save money themselves.

If you make your kids earn their own money as a way of teaching them about responsibility, they are less likely to take risks with their savings because it is theirs! The earlier children start saving for something, the more time they have to save up for a valuable, larger purchase that they may want.

How do you actually teach the money concept?

This fully depends on the age that you start teaching kids the concept of money but if they are really young, you can start by teaching them how to count coins. Once they get into the later childhood and tween years, you can introduce money concepts like saving and exchanging.

Teaching Little Children

Many people find that teaching young children about money concepts can be difficult, but it’s important to start early!

Kids need some guidance from parents and teachers who have learned these skills themselves so that we are not the ones teaching everything. This can be done through role-play, modeling our own behaviors by spending wisely, saving responsibly & living within our means; reading books about money concepts, or taking them on a trip to the store with a little cash for the practice of counting out change.

Make it fun: use a piggy bank as an outside savings account–kids love playing store too! Imagination is key when trying to figure out how to help them connect with the concept of money

Let’s help kids make up their minds about what they want and how to get it LONG before they are forced to make major financial decisions later in life.

Teaching Preteens

How do you teach a preteen about good money habits? Preteens are at an age where they can really start learning some of the basics about money- but again, we need to be careful not to overburden them with too much information and expectations. They also will learn plenty from watching you…so make sure that your actions match what you say!

Preteens are at an age when they really start seeing the benefits of independence here and there. Giving them some room to spend some of their money while also teaching them to set goals and save for a larger expense is really valuable.

Teaching Teenagers

It can be tough to teach teenagers responsible financial skills, but here are a few easy ways to help them learn.

Once they get an allowance, a job, or are earning money in other ways, give them responsibility for their money and let them make decisions about what to do with it…based on parameters you both agree to before money is earned.

Teaching your children how to manage your budget takes time and patience. In order to let the skills really sink in, they need to be implemented and repeated consistently. Don’t get me wrong…anything you do to teach your kids about money habits will be beneficial; but to make a lasting impact, do your best to be consistent and intentional in the way you teach them.

Try these strategies or come up with your own:

Discuss the trade-offs and sacrifices that are necessary for financial success; don’t just wait until they need to make a big decision to teach them about how important money management is!

Keep an eye on their spending habits, talk openly about finances as often as possible (even when it’s not fun!), and set clear expectations around saving versus spending. Teens could be responsible for paying bills like cell phone bills themselves after high school graduation (if not sooner).

Saving responsibly – Kids can start learning what “saving” means by setting aside any money left over after paying bills each week/month into a savings account so they have something saved in case of emergency, or if there is some unexpected expense like car repairs…or even birthday presents for family or friends.

You could also discuss with your child the kinds of things they might want to buy if they had more than enough saved up – such as a car or going to college one day. These are important conversations because this way children know how much hard work goes into earning money!

I’ll repeat this again…one of the most important ways to teach your kids about money regardless of their age is to show them by example–for instance, making sure that you’re always setting aside money and saving it in a place where they can see it.

When there is an occasion like Christmas or their birthday, where they may get money from you or others as a gift, make sure that they don’t spend all of the money right away. Instead, encourage them to save up some of the money so he/she will have something extra for later on in life.

Should I pay my child for doing chores?

A common question that parents have is whether or not to pay their children for completing chores. There are pros and cons to this, but those who think it’s generally a good idea usually cite the following benefits:

– Kids will be more likely to complete the tasks if they know there’s money on the line (especially when they’re younger)

– They’ll learn valuable skills such as task management, time management, budgeting of funds, etc…things that are very important once they start working full time. And we can’t forget about how those skills will help them throughout life too!

However, sometimes paying your child might backfire so there are some other things you could try instead:

– Try paying them after every few days or after each week of completed work–rather than every day.

– Offer a bonus for completing the chores without any reminders or complaints from you (they might also get extra money if they didn’t ask to be paid).

– If your child is old enough, see what it would cost to pay them under minimum wage and give them that amount–as long as they’re comfortable with working at home and not out in public. You can also take into account inflation…it’s possible their salary will increase every year!

-It may seem like an afterthought but encouraging children to save half of their earnings is important too; this way they’ll learn how to spend responsibly when the time comes.

On the other hand, there are many people who feel kids should not get paid for household chores or receive an allowance. Many parents decide not to give their kids an allowance because they want their children to learn how to work for what they have. They feel that giving kids an allowance can lead them into feeling entitled because it may seem as if the money is always there and they never really need to make an effort with chores or doing anything around the house.

Typically the reasons they use for not giving their kids money include:

– Kids shouldn’t be paid for doing something they are expected (and obligated) to do at home.

– Parents may have unrealistic expectations and as a result, which could lead kids into thinking that their time and skills need to be bought–which is not true!

How much should I pay my kid for chores?

The amount of money a parent should pay their kid depends on what amount the parent feels is appropriate, based on the family economic situation, the age of the child, the cost of living in that family’s area, how much work is required, and what other responsibilities are expected. Some kids may only be able to make a few dollars per week, while other kids might make more than $50 per week. Find a balance that is right for your family situation.

Very young children are excited about earning any money at all so they can usually get paid in smaller amounts. Older children might want to earn more money, depending on their family’s financial situation.

In general, the following are some ranges a parent could work with:

– Younger kids around $0-$20 per week

– Tweens and teens who do much of the household chores may be paid $25-$50 per week for these tasks.

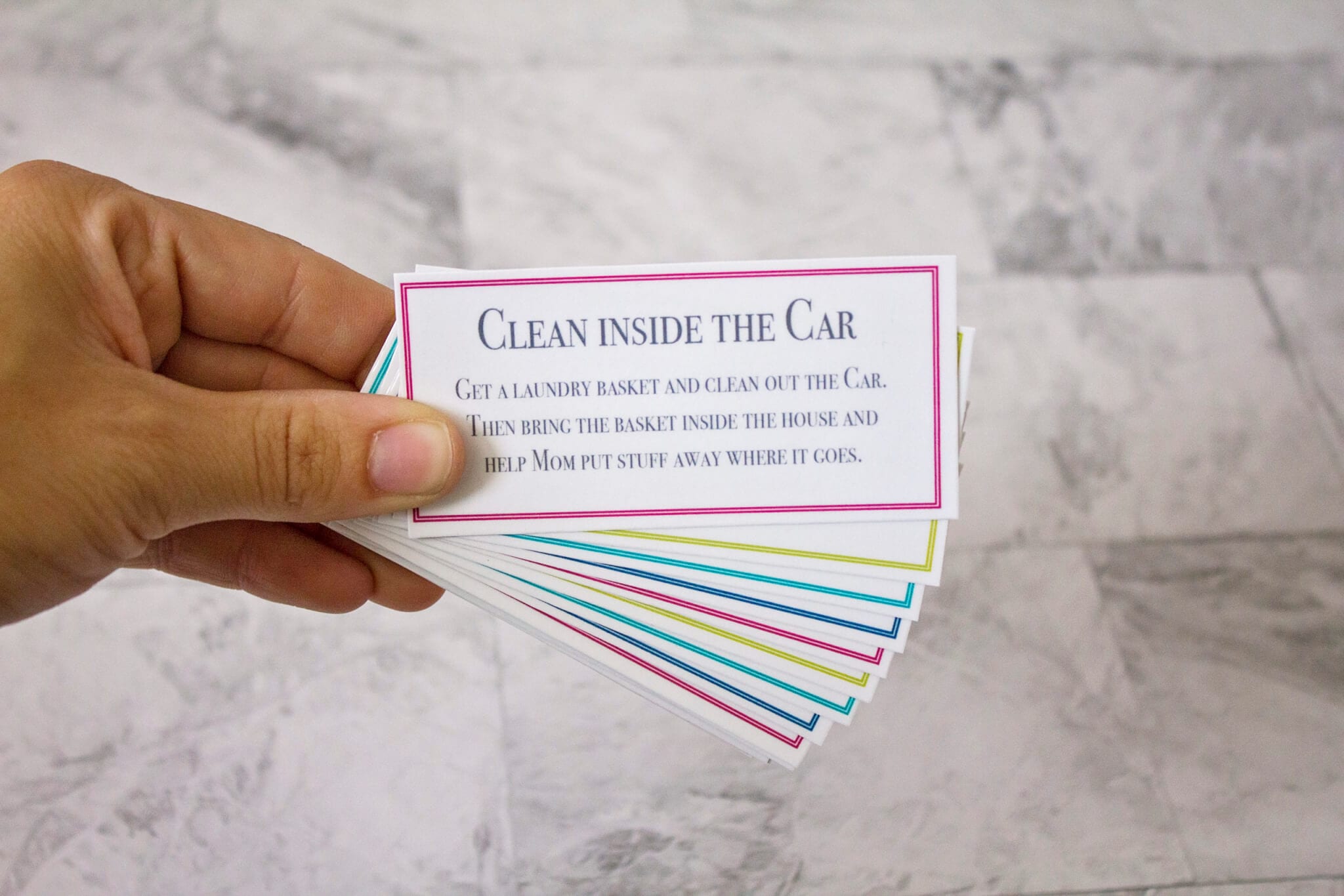

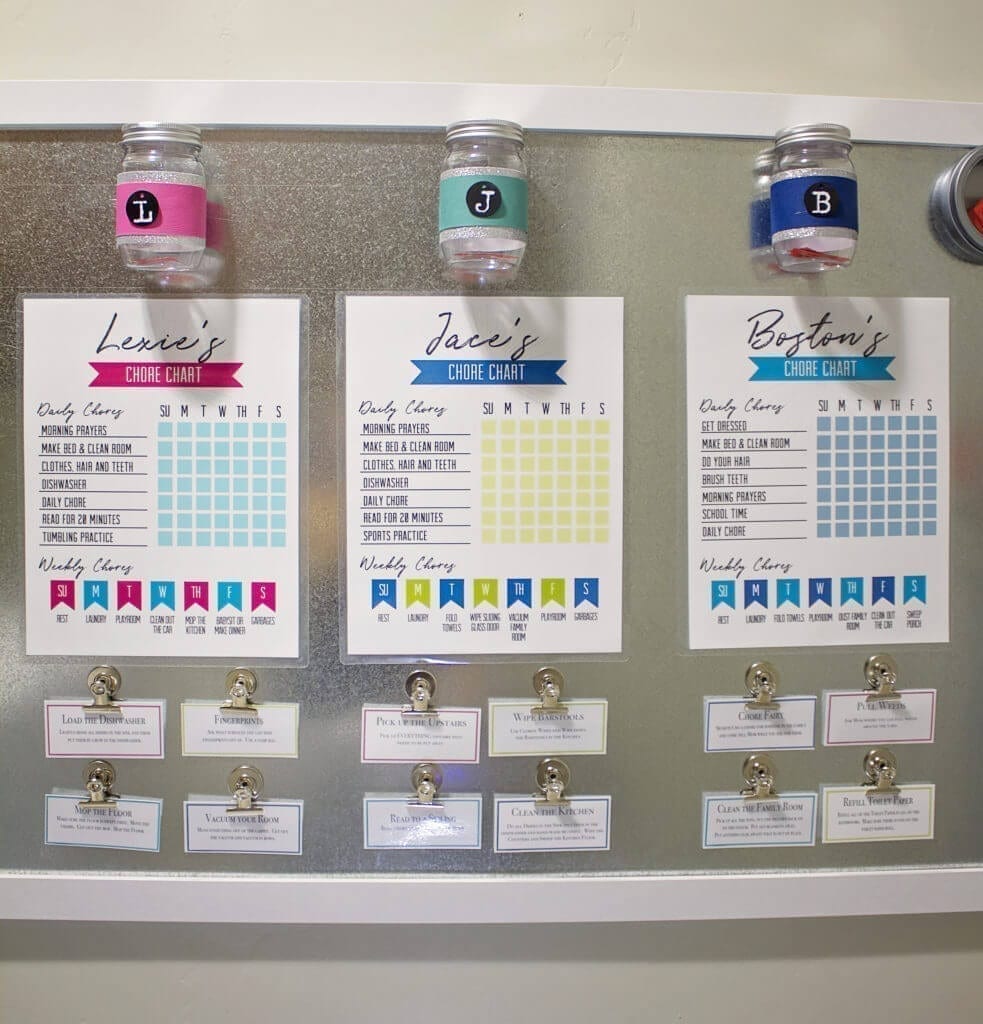

You could also consider creating a system where you meet somewhere in the middle. This is what we do as a family. My kids have chores that they are expected to do just because they are a part of the family and they need to help out around the house. This also helps them learn important life skills.

However, I also give my kids the opportunity to earn money through extra chores or even through working toward positive behaviors. We have a list of chores (and the amount of money that will be paid) that my kids can choose from if they want to earn extra money. They also earn a certain amount of money for having good behavior for the day such as not fighting with siblings.

It may seem difficult to keep track of everyone’s money but I’ve found the most incredible system that has solved all of our kid/parent money problems. We’ve used the Greenlight Debit Card for kids for months now and I’ve completely fallen in love with it as a parent. It makes my job so much easier when it comes to teaching my kids about money. If you want more info about all of the incredible features above just a regular checking account, you can check out the Greenlight site or you can also read my article about it.

How can my preteen earn money without a job?

Some good ways for preteens to earn money is through tutoring other children in school subjects or by doing household jobs like mowing lawns, washing cars, picking up litter around town (they could even do this while walking their dog!), or by babysitting younger children in the area. Keep reading for a list at the bottom of this article. Or you can skip right to my article with 104 Ways to Earn Money as a Kid.

How can my teenager earn money without a job?

Teens can make money by doing things around the house or helping family, friends or neighbors with tasks that they don’t want to do themselves. If you can find a task that many people don’t want to do (that still needs to be done), you may have a business idea that you can explore! Here are a few ideas:

– Babysitting younger children in the area

– Painting houses (many teens are excited about this opportunity)

– Doing yard work, including weeding and planting flowers or vegetables. They could also do some light landscaping to include mowing lawns and trimming hedges. Teens may have a higher price than preteens because they often require more experience for these jobs.

– Kids will be more creative in their job search because they have a different perspective than an adult. They may come up with ideas you never would have thought of, such as starting their own business or selling items online using Shopify (a website that helps people sell things on websites).

– Kids are often driven by passion so if there is something they love doing like baking cookies for example, then why not pay them to do more? When kids bake cookies from scratch and deliver them door-to-door, they can charge $0.50 per cookie plus whatever ingredients cost: flour, sugar…etc.)

(Again, a full list @ the bottom of this article.)

Are there any safe ways my kids can make money online?

Unfortunately, there are VERY few safe ways for kids to make money online. Kids should not post their email addresses on public websites or social media sites where they can be contacted by strangers and told that they’ve won a contest when in reality the person is trying to gain access to your child’s personal information.

Some scams may seem like such an awesome idea at first (like creating an online game) but can quickly turn into something bogus. The risk of getting scammed outweighs any potential benefits from this type of work experience so it’s best avoided altogether.

One of the very few ways to make money online is by creating handmade items and selling them on Etsy! I have a huge list of ideas for things that kids can make and sell online if they choose. They can also sell them door to door or at a local market!

List of money earning ideas for kids of all ages–all without getting a job:

- Lemonade Stand

- Apple Cider Stand

- Hot Cocoa Stand

- Pull Weeds

- Walking Dogs

- Pet Sitting

- Selling Old Toys

- House Sitting (watering plants, etc)

- Raking Leaves

- Shoveling Snow

- Make and Sell Chocolate Covered Strawberries

- Pressure Wash Garbage Cans

- Sell Candy to Classmates

- Sell Bottled Water at Small Sporting Events

- Selling Flowers From Yard (as approved) 😊

- Sell Cookie Dough

- Sell Paper Airplanes

- Paint and Sell Rocks

- Sell Home Made Slime

Teaching your kids about money is one of the most important things you can do. You may not have thought to include them in your finances, but it’s actually a good idea. They need to learn these skills early on and be prepared for the future when they will be making their own financial decisions! It’s great if they’re learning how to earn money by working hard now because this will come in handy later in life–especially during those inevitable years where there isn’t quite enough coming into the household budget. Plus, teaching kids about money at home means more family bonding time.

How do you teach your kids about money? I’d love to hear your ideas!