11 Excellent Reasons to Get the Greenlight Debit Card for Kids

Parents often seek effective methods to educate their children about financial literacy from a young age. The Greenlight debit card emerges as a practical solution to this common challenge. Specifically tailored for children, this card facilitates parental allowance distribution, enforces spending boundaries, and instills saving habits in young minds.

The Greenlight card is not just a financial tool but also an educational resource. Children learn vital money management skills, including the basics of investment, fostering a foundation for financial acumen that will benefit them in adulthood. Each feature is meticulously designed to offer practical, hands-on financial learning experiences, balancing autonomy and parental oversight.

It’s important to clarify that this endorsement is unsolicited and uncompensated. My admiration for the Greenlight Debit Card for kids stems from personal experience and genuine appreciation. It has proven to be an invaluable resource in our family, seamlessly blending financial control with educational insights.

Need more ideas? Check out Free Printable Chore Charts for Kids and The Only Chore System You’ll Ever Need!

Is Greenlight debit card legit?

Is the Greenlight debit card legitimate? Yes, it is! Our family has used the Greenlight debit card for several months, and we highly recommend it. This card simplifies life for busy parents.

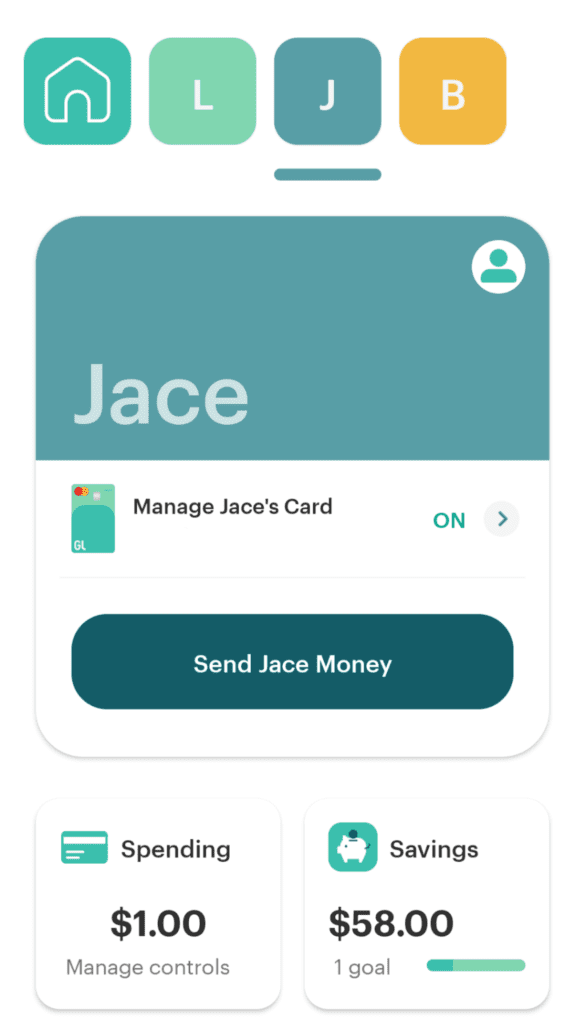

What is the Greenlight debit card? It’s a product by Mastercard designed for children. Think of it as a reloadable gift card. With the Greenlight card, parents can add money to their child’s card using a user-friendly mobile app. This app even offers an option for scheduled allowances, eliminating the need to remember weekly payments.

A unique feature of the Greenlight card is spending control. Parents can specify where their children can spend money, preventing excess spending in categories like online gaming.

Additional benefits include financial education. The card teaches children about investing. It allows parents to set spending limits, make online purchases, and manage allowances without needing physical cash.

How much does Greenlight cost?

The Greenlight debit card offers affordability at $4.99 monthly, covering up to 5 cards. I pay this fee for the three cards used by my children. The app provides various features without additional monthly charges. Notably, this price includes cards for up to five users.

They also have added features that can cost a bit more if those are features that you’re interested in.

There are premium features available for an additional cost. The highest-priced plan, at slightly below $10.00 monthly, brings added benefits: investment options, identity theft safeguards, and purchase protection in case of card loss.

Furthermore, some valuable features come at no added cost: establishing spending caps, teaching charitable giving, setting up regular allowances, and implementing parental controls.

What age is Greenlight card for?

The Greenlight debit card for kids is excellent for any age! I have been using it for all three of my kids. Ages 6, 9, and 11. The level of freedom with which my kids are allowed to use their card varies by their age. I definitely feel comfortable allowing my oldest daughter (who’s really responsible) to take her debit card with her to walk to the local cookie shop with her friends. While my youngest I’m a bit more cautious with what I allow him to do with it.

In order to make their debit cards easier to keep track of, I went to Five Below and allowed each of my kids to pick out a cardholder/lanyard. It has really helped them to keep track of their cards and when I do allow them to carry their cards around, they are safe around their necks.

Generally, I keep the Greenlight cards in my purse/backpack though when they aren’t using them.

How much money can you put on a Greenlight card?

There are certain loading limits to the card that you may want to be aware of. These stats are directly from the Greenlight FAQ page that you may find helpful that have even more details than what is listed below.

If you are planning on putting large amounts of money on your child’s card, I highly recommend that you upgrade to the Greenlight Max plan so that you can make sure that your child’s money is protected if they lose their card.

- Maximum Balance for a Primary Account$10,000

- Maximum ACH Load per Day per Primary Account$100

- Maximum ACH Load per Month* per Primary Account$300

- Minimum Direct Deposit Load amount per Sub-Account$1

- Maximum Direct Deposit Load per Month* per Family$5,000

Do kids need a phone to use the Greenlight Debit card?

An outstanding feature of the Greenlight debit card is its independence from the need for a phone or app, which is especially valuable for children. I prioritize limiting my kids’ screen time and ensuring they don’t spend money mindlessly.

Many parents share my concerns about introducing smartphones to their children at an early age, given the potential harm it can cause. With the Greenlight debit card, there’s no requirement for a companion app (at least not for the kids). This means children can use it at any store of their choice. However, they should consult with you beforehand to check their available balance and avoid overspending.

Moreover, parents have the ability to activate or deactivate specific card features, allowing them to set weekly spending limits for their children. I find this functionality particularly beneficial as it helps instill a sense of responsibility and financial discipline in children, which can have long-term advantages for their future.

How safe is the Greenlight card?

The folks at Mastercard have thought of everything when it comes to keeping your kid’s money safe. According to the Greenlight FAQ page, “Greenlight blocks ‘unsafe’ spending categories, sends real-time transaction notifications, and gives parents flexible ATM and other spending controls. We also provide additional layers of protection to our families in the form of face or fingerprint recognition and the ability to turn your card on or off directly in the app.”

So if your child loses their app and you’re worried that someone has stolen it, you can very easily turn the card off on the app to disable any unwanted spending from a stranger. This gives you more time to look for the card without stressing about whether the money is being spent.

Another great feature of the Greenlight card is the feature that alerts you as the parent if any sort of money has been spent and from where. You’ll get a text message stating how much money has been spent on which child’s card and at what store. If your child hasn’t spent money at that store, then you know that the card has been stolen and you can quickly turn the card off on the app. This gives me huge peace of mind as a parent that even if I have a child who loses a card, I can act quickly so that the remainder of the money isn’t spent.

Then you can quickly contact the company about the fraudulent charges. The Greenlight FAQ page also mentions that “Greenlight debit cards are FDIC-insured up to $250,000, and come with Mastercard’s Zero Liability Protection.”

Can parents see what kids buy on Greenlight?

One of the standout features of the Greenlight debit card for children is its ability to provide real-time alerts. As a parent, I receive instant notifications on my phone for every purchase my kids make with their Greenlight card. This feature empowers me to closely monitor their spending habits and offer guidance to help them make informed choices.

Imagine if your child went shopping with a friend and spent $60 at Dollar Tree; you would receive a prompt notification on your phone, such as ‘Sara spent $60 at Dollar Tree.’ While this might initially trigger some concern, it also grants you the opportunity to address any potential issues that may arise.

The ability to view your children’s transactions with the Greenlight card not only helps prevent potential problems but also creates valuable teaching moments. It allows you to impart important lessons about responsible spending and saving money, which is a fundamental aspect of our role as parents – to educate and guide.

Do kids like the Greenlight debit card?

We have equipped each of our three children with Greenlight cards, and each one of them has expressed immense excitement at the prospect of having their own debit card. This newfound financial independence has prompted growth in their maturity, particularly in terms of their saving and spending habits (albeit to varying degrees).

The Greenlight debit cards for kids have opened up numerous opportunities for us to engage in meaningful conversations about expenditure, saving, and the importance of setting larger financial goals, rather than indulging in endless treats every time we visit a store.

Additionally, it has been enlightening to observe the distinct spending and saving tendencies among our children. With the Greenlight debit cards, I can easily discern these patterns, watching as one child’s balance rises while the other two’s gradually diminish, despite their continuous earnings.

Furthermore, as a parent, it has relieved me of the burden of having to make instantaneous ‘yes’ or ‘no’ decisions regarding their purchases at stores. Instead, I can act as a guide, reminding them of their overarching savings objectives when they express the desire to buy a treat or a beverage.

How does the Greenlight Card help kids save?

They literally have thought of everything when it comes to helping kids learn how to save money. They have the option to set up savings goals (multiple if you want!) to help remind and motivate them to save their money for something more worthwhile instead of just candy.

My favorite feature is the ‘change’ feature where you can choose where the leftover change should go after purchase.

For example, if your child spends $1.80 at the store, you can choose where the remaining $.20 goes (rounded up to the nearest dollar). You can choose to have it remain in their spending account or you can have that $.20 automatically transfer to their general savings account! There are entire apps that do that for adults to help them gradually build savings accounts. It’s basically a painless money-saving technique that you or your kids won’t even notice.

Are there any downsides to the Greenlight debit card?

In the few months of using Greenlight debit cards, I haven’t found any missing features. At one point, I thought I had discovered a feature not included in the app. However, after further exploration, I realized the feature had been there all along, just located in a different place than I initially thought.

Describing the thoroughness of the Greenlight Debit Card for kids is an understatement. I’m delighted to have found this tool, which has become an invaluable asset to our family, greatly simplifying my life. No more trips to the bank to get cash for my kids’ extra chores – I can simply provide them with a card and let them handle it.

These Greenlight debit cards are incredibly user-friendly; my kids even taught themselves how to use them! They easily grasped the various features, like setting up an account for saving or investing their allowance. This not only empowers children but also frees up more time for parents.

Thanks to our experience with Greenlight debit cards, I’m confident that my kids will have solid financial literacy by the time they turn 18.

Thank you for sharing this! Are there other options for cards that don’t have a monthly fee? I assumed it would be free to get them a card of their own. That really adds up over the year with several children.

Luckily, it’s only $5.00 for up to 5 children! So that’s awesome! The free option would be just to get each child their own debit card from your local bank. I hope that helps Liina!